PREA Quarterly Feature - Summer 2022

Mark Witschorik

Mark WitschorikJamestown LP

Brad Petersen

Brad PetersenJamestown LP

The convergence of physical and digital experiences has long been described in scientific and fictional work as inevitable. In the 1980s, the advent of home- and work-based computers began the journey into the digital world. In the 1990s, the internet connected the global population like never before and changed the way the world does business. In the 2000s, social media transformed the online user experience and created platforms for social connectedness. Now, digital currencies and the metaverse are poised to revolutionize the ways in which people conduct financial transactions and interact with their physical surroundings. Emerging technologies are hastening this intersection, and the rise of a new, experiential internet that extends beyond phones and computers and into the physical world—the Internet of Everything—has changed the expectations of tenants and consumers in real estate.

Leaders in the real estate industry play a role in this evolution. They will shape what the world of digital real estate will look like and how tenants and consumers will experience the space.

Introduction to Digital Currencies and Ecosystems

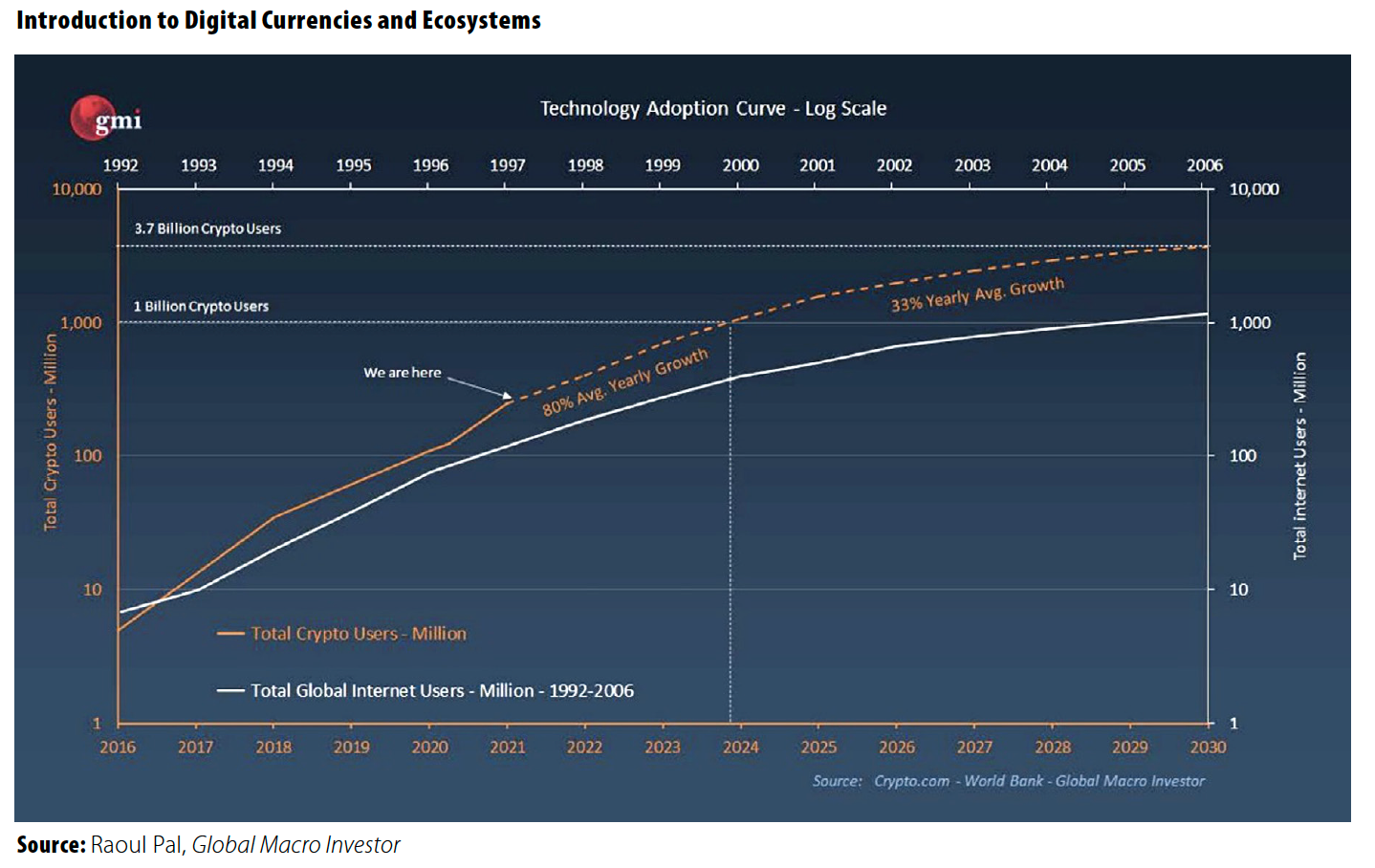

Like other technological paradigm shifts, the adoption of this technology builds upon the disruptions that proceed it. According to Raoul Pal, chairman of Global Macro Investor, digital assets are being adopted faster than any other technology in history, including the internet.

The technologies and ecosystems—known as digital assets—that form the groundwork for this new space have the potential to transform the ownership and governance of goods and services. A distributed-ledger technology, commonly referred to as a blockchain, serves as the foundation of this enhanced network by providing digital property rights. Many investors ask What is this new space? What potential does it have to change the real estate industry? How can I invest in it?

The goal of this article is to demystify digital assets and blockchain technology and share insights about Jamestown’s strategy to capitalize on this digital revolution. We explore Bitcoin, the original distributed ledger; the macro digital asset ecosystem, including alternate blockchains and the metaverse; and the Jamestown Digital Asset Strategy.

Bitcoin and Blockchain Technology Lay the Foundation for the Digital Asset Ecosystem

Bitcoin introduced the world to blockchain technology and the decentralized ledger, commonly referred to as cryptocurrency, following its release in 2009 by its pseudonymous creator, Satoshi Nakamoto. The system delivered a first-of-its-kind, peer-to-peer settlement system, eliminating the need for a trusted third party to verify and record a transaction.

The Bitcoin protocol records transactions in an open-source and public block of information. These blocks are then added to the chain of past transaction blocks after miners validate them. Miners are rewarded for their efforts with Bitcoin tokens in a process known as “proof of work.” They also secure the network with their collective computing power and to date have prevented the protocol from being hacked. A limit of 21 million Bitcoins can be mined, and the reward to miners for their work halves every four years. Approximately 19 million Bitcoins have been mined to date, and at the present mining rate, the last Bitcoin is expected to be mined in 2140.

Bitcoin as an asset has no intrinsic worth but derives value from immutable proof of ownership, portability, and a frictionless settlement network. In a matter of minutes, a Bitcoin owner can transfer uncapped value to anywhere in the world with minimal transaction costs. By comparison, the existing financial system can take days for bank accounts to transfer funds, weeks to wire currency internationally, and a month for settlement between retailers and credit cards.

The Bitcoin network explains the exponential growth of Bitcoin as an asset. Its growth trajectory has followed a similar exponential path of technology network companies such as Amazon, Facebook, and Google. This growth is explained by a concept known as Metcalfe’s law: as a network grows, the value of the network grows exponentially for its users. The value of Bitcoin as an asset is subject to extreme volatility to the upside and downside, often impacted by significant changes in the size of the network.

Bitcoin environmental, social, and governance (ESG) considerations have primarily focused on the power consumption of the network, which surpasses that of some small countries and uses 1% of the global power produced annually. Historically, miners have gravitated toward cheap power and purchased power production from coal and natural gas facilities. Recognizing the ESG concerns, the industry is shifting. Today, more than half of all Bitcoin mining is done through renewable power generation, compared to 12% across the US power grid, according to the Bitcoin Mining Council.

From a social perspective, Bitcoin provides an alternative to the traditional financial system for the unbanked population, roughly 20% of the US and 50% globally. Through Bitcoin, the unbanked have an opportunity to store wealth and transfer it without incurring the fees and higher interest rates charged to those without a credit history in the traditional financial system.

Alternate Blockchains Are Decentralizing Industries Outside of Finance and Building a Macro Ecosystem

Although Bitcoin remains the largest component of the digital asset market, similar protocols have emerged that offer new blockchains and their own cryptocurrency tokens. Together, they are building a diverse crypto ecosystem with use cases that are united by the common theme of decentralizing ownership and governance.

Decentralized applications (dApps) built on these blockchains have the power to transfer the value of data to the user and eliminate the need for a traditional, centralized party. Users may be incentivized to leave a centralized system and seek a decentralized version that provides a financial reward for its use.

The Ethereum network has emerged as the second largest digital asset and hosts more than 3,000 dApps. Like Bitcoin, it features both a blockchain and its own crypto token incentive for its users. On the Ethereum network alone, there are scores of nascent applications with use cases that include search, social networking, and gaming.

Non-fungible tokens (NFTs) have emerged as a popular use case for retail investors. These are smart, programmable contracts on the blockchain that record ownership for physical and digital goods. NFTs can be a commodity item available for free, such as an avatar in a video game. They can also be rare and valuable, such as the piece of digital art Christie’s auctioned in 2021 for more than $69 million. Because the ownership of the asset is recorded in a digital contract that lives indefinitely on the blockchain, an artist can participate in subsequent transfers of the same NFT. For example, if Picasso had been able to tokenize his works as NFTs, his family would have received a portion of the sales proceeds each time his work was sold indefinitely.

Decentralized, Blockchain-Based Metaverse Platforms Blend Built and Virtual Environments

The concept of a virtual, interactive world outside a person’s physical experience has been made popular by movies such as The Matrix, Ready Player One, and Tron. The term metaverse, first used to describe the virtual world in Neal Stephenson’s 1992 novel Snow Crash, has been embraced in popular culture as the name for emerging virtual worlds.

Closed, interactive virtual worlds such as Fortnite, Roblox, and Minecraft have progressed toward a metaverse experience and amassed hundreds of millions of users over the past ten years. These platforms are owned and governed by central parties that trade low-cost or free-to-play utilities for control of users’ data. The use case for these platforms has evolved past gaming and into a social network, where recent virtual concerts with artists such as Ariana Grande and Lil Nas X drew tens of millions of attendees. Meta (Facebook’s parent company) has invested approximately $10 billion into the development of its virtual and augmented technology hardware and aims to connect its 3 billion–member user network through hybrid physical and digital experiences.

Decentralized, blockchain-based metaverse platforms have emerged that offer users ownership and governance of the platforms. In one of the leading decentralized worlds, Decentraland, users acquire digital plots of land with a capped supply. On these digital parcels, owners can build structures, games, and experiences that can be monetized and exchanged on a blockchain. These platforms have also evolved to create microeconomies that feature play-to-earn incentive mechanisms that reward users for the value of their skills.

Daily user counts for decentralized metaverse platforms number in the tens of thousands but feature financial incentives for users that should provide tailwinds for network growth. Metaverse platforms that provide digital complements to physical places and experiences through augmented reality will be poised for success in the Internet of Everything.

Jamestown’s Digital Asset Strategy Focused on the Future of Real Estate Investment

Jamestown expects the transition to a digital asset economy will digitize ownership and control of physical goods and services, including real estate. We believe this convergence will accelerate as augmented reality technology and tokenization unlock new hybrid experiences in our portfolio.

In anticipation of this expected change, Jamestown developed a strategy that meets the needs of our tenants and investors and leads the real estate industry toward widescale adoption. Jamestown’s Digital Asset Strategy focuses on the following four key themes:

—Michael Phillips, president of Jamestown

- Metaverse Experiences The instant demand for virtual, immersive experiences at the onset of the COVID-19 pandemic presented an opportunity for Jamestown to be one of the first real estate investment firms to enter the metaverse space. Jamestown owns One Times Square in New York, one of the most recognizable buildings in the world, and helps manage the New Year’s Eve ball drop each Dec. 31. As the pandemic rendered a large, in-person event unfeasible, Jamestown produced an immersive virtual New Year’s Eve experience in 2020–2021 that allowed the public to enjoy the festivities virtually through a dedicated mobile app and website that featured music and entertainment acts, “rooftop” VIP lounges, cryptoart galleries, and immersive games. Jamestown continued this evolution for New Year’s Eve 2021–2022 by partnering with Digital Currency Group, a leading investor in the digital assets industry. The partnership recreated One Times Square in Decentraland, the leading decentralized virtual world, and staged MetaFest2022.

“The future of real estate is the thoughtful integration of the virtual and physical worlds, optimized for user experience,” said Michael Phillips, president of Jamestown. “The metaverse is an important part of the evolution of real estate and the built environment. Whereas physical real estate is largely limited to people with geographic proximity, the metaverse can give people around the world meaningful access to places through immersive virtual experiences. Recreating One Times Square in the Decentraland metaverse is part of a larger Digital Asset Strategy to evolve and enhance our physical real estate for Web 3.0 and open new pathways for our assets to exist in multiple metaverses in the future.”

Jamestown is researching, developing, and investing in companies and platforms that bring together the built and virtual environments. As one of the first in the industry to realize and invest in the limitless potential of this space, Jamestown is poised to continue to be an industry leader for years to come. - Cryptocurrency Integration In April 2022, Jamestown announced it will accept rent payments in the form of cryptocurrency through a partnership with BitPay, the world’s largest provider of Bitcoin and cryptocurrency payment services. The program includes Jamestown’s properties in the US and a plan to expand to Europe, making it one of the most significant cryptocurrency payment programs to date in the commercial real estate industry.

“Blockchain technology and the digital assets it enables, like cryptocurrencies and non-fungible tokens, are key components to the evolution of real estate,” said Phillips. “Allowing for cryptocurrency payments is part of our commitment to innovation ... through technology and virtual integrations.”

Through BitPay, Jamestown tenants will be able to make rent payments in a range of cryptocurrencies that initially include Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Wrapped Bitcoin (WBTC), Dogecoin (DOGE), Litecoin (LTC), and five US dollar–pegged stablecoins—Gemini dollar (GUSD), USD Coin (USDC), Paz Dollar (USDP), Development Alternatives, Inc. (DAI), and Binance USD (BUSD). BitPay will serve as the intermediary between Jamestown and its tenants for all aspects of the rent payment program. Jamestown will not receive or hold cryptocurrencies. - Tokenization and Decentralized Autonomous Organizations Jamestown is developing a strategy that will establish first-mover status, while focusing on ensuring regulatory transparency and token security. The company is a member in an early- stage real estate Decentralized Autonomous Organization (DAO) that features blockchain-based ownership of a real asset. Jamestown is looking into options to tokenize assets and record their ownership on a blockchain but will not proceed until clearer regulations have been developed for digital assets in the US.

- Venture Capital Investments Jamestown is utilizing its relationships with founders and executives in the digital asset space to invest in companies building the infrastructure for this evolving digital economy. Included are digital pioneers that are creating new protocols that will enable the financial services industry to access the efficiencies of blockchain and disintermediate an industry that has relied on manual processes for too long.

Conclusion: Poised to Unlock the Power of Digital Assets

Technology is a disruptive force in real estate, from the rise of e-commerce to the more recent remote-based work-from-home movement. These disruptions, like others in the past, created a series of winners and losers whose outcome was delineated by the ability of investors to anticipate and adapt to change. Jamestown developed a Digital Asset Strategy to prepare for the convergence of real estate and digital assets and to unlock the power of the underlying technology for our investors and tenants.

Although recent volatility in Bitcoin has raised concerns about its long-term viability, economist Lyn Alden notes, “Nothing is for certain, but when something survives seven or eight separate 50%+ drawdowns and continues pushing towards new highs in terms of value, the burden of proof begins to shift to the detractors.”

Though the price of digital assets is volatile, the rate of network growth is consistent and exponential—and its intersection with real estate is underway.

Mark Witschorik is a Director, Digital Asset Strategy, and Brad Petersen is a Director, Investor Relations, at Jamestown LP.

This article has been prepared solely for informational purposes and is not to be construed as investment advice or an offer or a solicitation for the purchase or sale of any financial instrument, property, or investment. It is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. The information contained herein reflects the views of the author(s) at the time the article was prepared and will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing or changes occurring after the date the article was prepared.

About PREA

About PREA