PREA Quarterly Feature - Summer 2023

Paul Leonard

Paul LeonardNuveen Real Estate

Andy Schofield

Andy SchofieldNuveen Real Estate

Harry Tan

Harry TanNuveen Real Estate

Donald Hall

Donald HallNuveen Real Estate

Chad Phillips

Chad PhillipsNuveen Real Estate

The global office market offers both opportunities and risks in the years ahead, with wide variability in outcomes depending on market; asset quality; and environmental, social, and governance (ESG) criteria. Would it surprise you to learn that the Seoul office market has a 2.6% vacancy rate and that the outlook is favorable enough that multiple hotel-to-office conversions are underway? Or that Europe has more demand for green office buildings than there is supply? Within the US, Class A space (particularly of newer vintages) continues to see resilient demand from tenants and commands a premium on rents. With investors largely shying away from the space, opportunities may be ahead to pick up assets at a favorable basis. The horizon is foggy, however, so before attempting to select winners, analyzing how the market got here and what tenant space requirements might look like in the future and why is important.

Widespread Adoption of Remote Working Provided an Unprecedented Look Into Worker Productivity from Home

Although office-using businesses continued operations largely uninterrupted during the COVID-19 pandemic, many asked employees to work from home, and some clear advantages and disadvantages emerged. The advantages mainly revolved around individual work requiring deep concentration and limited distractions. Team building, corporate culture, informal mentoring, and onboarding of new employees all suffered in this environment. More recently, long-term remote working may be showing signs of weakness, with US labor productivity stagnating since the end of 2021.1

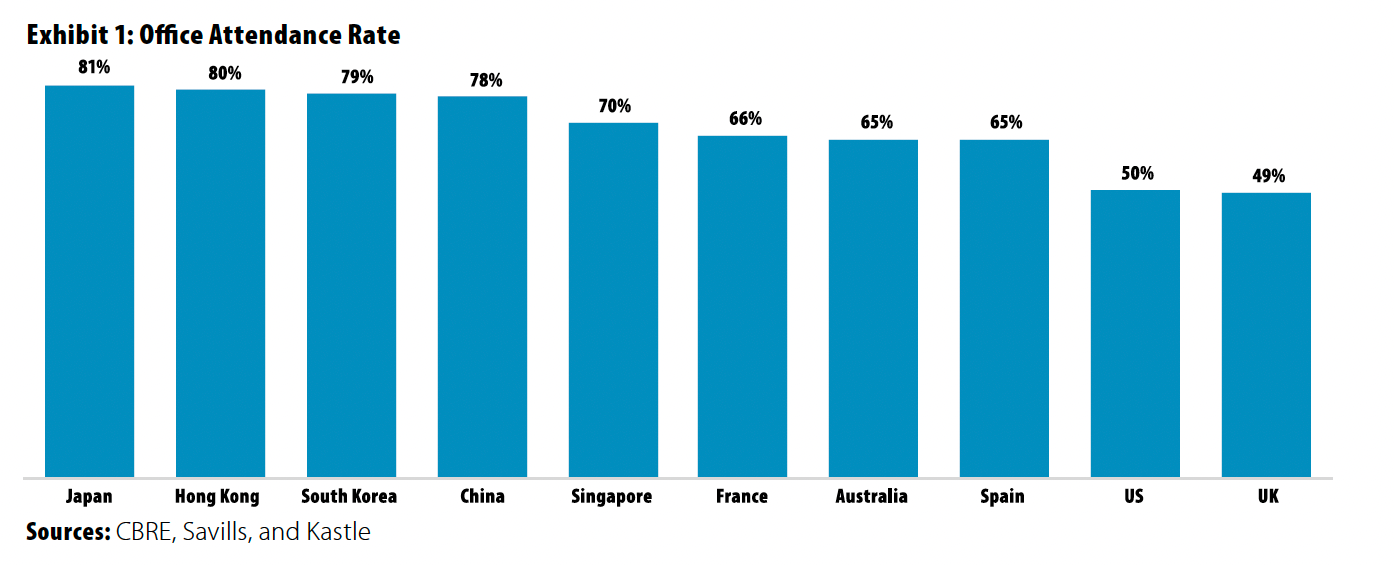

As pandemic-caused disruptions dissipate, most segments of life are returning to normal. However, workers’ return to offices continues to lag. No global region is fully back to normal attendance in aggregate, but the Asia-Pacific (APAC) region leads the way, followed by Europe and then the US (Exhibit 1). Cultural bias toward face-to-face interactions and team building have bolstered attendance rates in APAC. Additionally, tight living quarters in major office centers across both APAC and Europe have drawn workers back to offices at a greater rate. Finally, superior public transit in both APAC and Europe allows workers to spend less time and cost commuting, providing another strong incentive to return to offices. US attendance lags peers’ partly because of the heavy reliance on car travel and long commutes exacerbated by the state of infrastructure. Moreover, large living quarters relative to those of other countries make working from home more feasible for many. And finally, priorities of US workers have shifted, and they are hesitant to give up the ability to participate in a remote meeting until 5 pm and still make their kids’ school concert at 5:30.

The Health of the Labor Market Has Played a Significant Factor

Globally, labor markets are exceptionally tight, with near record low unemployment. Knowing that employers are trying to attract and retain top talent, highly skilled knowledge workers have leveraged this fact and demanded more flexibility. However, the pendulum has been slowly swinging back to employers since the fourth quarter of 2022. Rising interest rates across most major economies have increased the cost of debt, making company expansion challenging. This has particularly impacted growth sectors, such as high technology, which have cumulatively laid off more than 300,000 workers globally since last September, according to Layoffs.fyi. Although the dampening growth outlook helps balance power dynamics in the labor market, decelerating gains or outright job losses are never good for office demand.

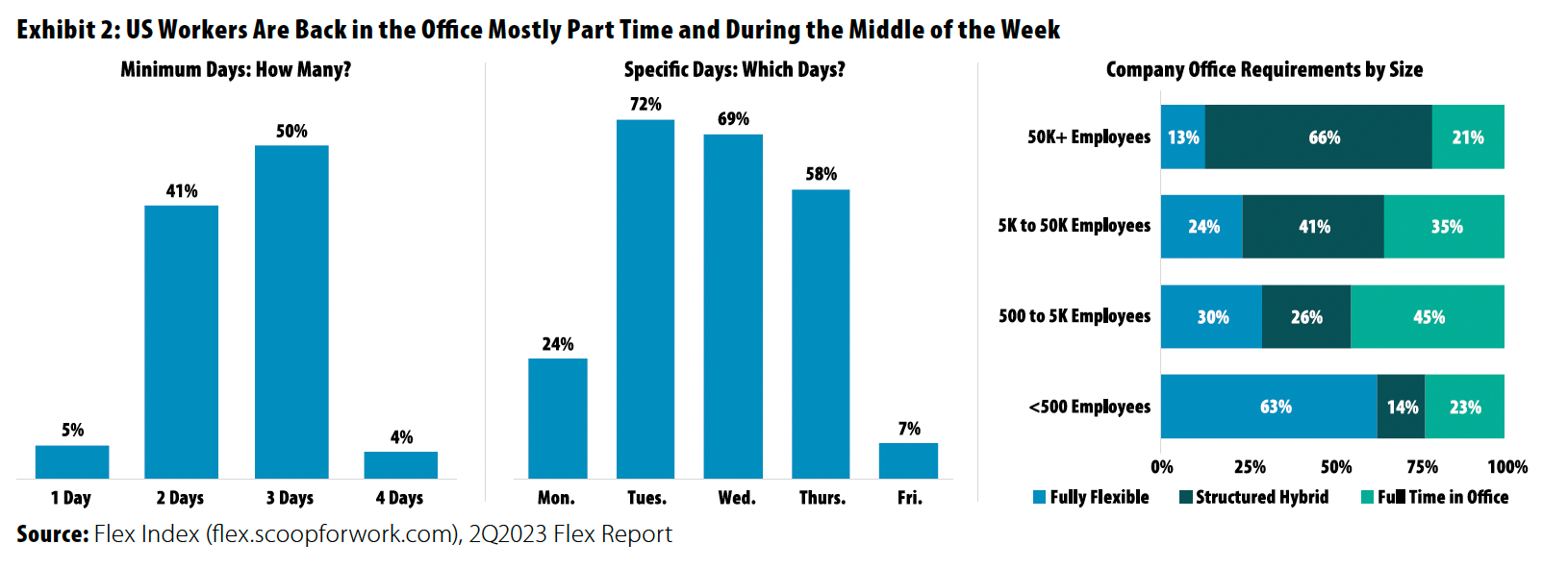

In the US, whether by choice or by mandate, office attendance peaks during the middle of the week at around 60% occupancy.2 Although office occupancy is still lower than anticipated, there is evidence of improvement. Most fully remote firms are moving toward hybrid schedules. Requiring a physical presence in the office for even part of the week keeps workers living and working in the same metro area, which has far-reaching ramifications across property sectors and markets. Conversely, many previously fully in-office firms are also pivoting toward hybrid models, thus muting the impact overall.

In-office attendance should improve further as firms continue to ease workers back to the office, but remote working is also here to stay, and hybrid schedules will need to be factored into future projections of office demand. But just how much demand will go away? The average daily occupancy was never 100%, even before the pandemic. Paid days off, business trips, client meetings, conferences, and occasional work-from-home days meant that offices operated well below capacity. Workers have always spent approximately 15% of their time, on average, out of the office.3

Factoring in the stabilized remote-working rates projected,4 a 30% decline in office attendance throughout the week across firms is reasonable. But this won’t translate into a 30% reduction in demand—workers at hybrid firms are clearly favoring Tuesday through Thursday for their in-office days (Exhibit 2). With most workers going into the office three days a week, drastically reducing space will be tough. A hypothetical firm with a three-days-in-office policy may have 50% of employees in on Monday, 75% in on Tuesday through Thursday, and 25% in on Friday. This hypothetical firm averages a 60% (three days) in-office attendance rate or, conversely, a 40% reduction in use throughout the week, but its peak days suggest only a 25% space reduction is feasible.

Remote Working Isn’t the Only Factor to Consider

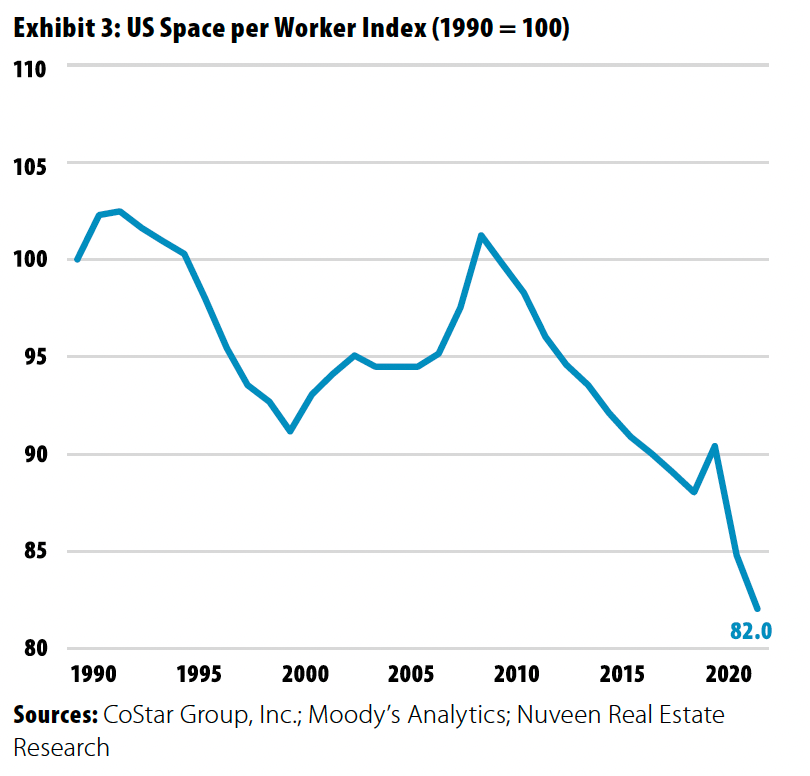

Over the past few decades, the average square footage allotted per worker has declined as open floor plans became in vogue, with proponents often touting the benefits of collaboration (Exhibit 3). However, these environments have been unpopular with workers and have actually decreased collaboration—the very thing CEOs are eager to encourage by pushing return-to-office policies. A 2019 Harvard Business Review study found that when firms switched to open offices, face-to-face interactions fell by 70%.5

The pre-pandemic trend in declining space per in-person employee is likely to reverse as companies draw employees back into the office and increase collaboration opportunities. A ratio of 1:1 is becoming popular—for each square foot of workspace, a square foot of space for different uses should be allotted. Those uses may include breakout rooms; informal, multi-person, diner-style booths; individual booths for privacy; lounge areas; and other creative spaces. Management leaders need to work hard at making the in-office experience worthwhile by bringing in speakers, encouraging debate/dialogue in group settings, and setting up social events. We believe the best amenity is people—and decision-makers at that. All the catered lunches and socials will be wasted without real human energy. Managers and up-and-coming leaders can stand out by fostering a culture of in-person collaboration.

Accounting for a modest 10% increase in the space allocated per employee would turn a hypothetical 25% space reduction because of hybrid work requirements into a 17.5% reduction. However, we think the 17.5% also isn’t accounting for something—job gains during the pandemic. According to Moody’s Analytics, between the first quarter of 2020 and the second quarter of 2023, office-using jobs grew by 5.9%. After factoring in these job gains that were not met with new office demand, the amount of square footage per office worker declines by 7.5%. Accounting for a normalization of office square footage per worker, not even the expected uplift reduces the potential decline in office demand by a further 43%. In summary, the next few years will still likely result in tenants reducing their floor plates but not by as much as expected.

Fewer Than Half of Leases Active Prior to the Pandemic Have Expired

The average office lease term blended across markets and lease types (i.e., new leases versus renewals) is 7.75 years, according to CompStak. Given the long-term nature of office leases, most active leases were signed prior to the pandemic, and these firms have not had the opportunity to make space decisions with full knowledge of the new hybrid environment. An estimated 42% of leases that were active prior to the pandemic have now expired, exactly in line with demand losses to date, suggesting the projected decline in space needs is on pace.

But in addition to factoring in recent job gains, considering future job growth is important. Over the next decade, says Moody’s Analytics, cumulative office-using employment in the US is expected to grow 7.6%. New supply also needs to be considered—modern product will undoubtedly take market share from existing buildings. But over the next decade, the US inventory is expected to expand by only 2.3% cumulatively, according to CoStar, a function of unfavorable construction financing terms, risk aversion to construction generally, and changes in the office sector.

The US Has an Estimated 10%, or 650 Million Square Feet, of Excess Supply

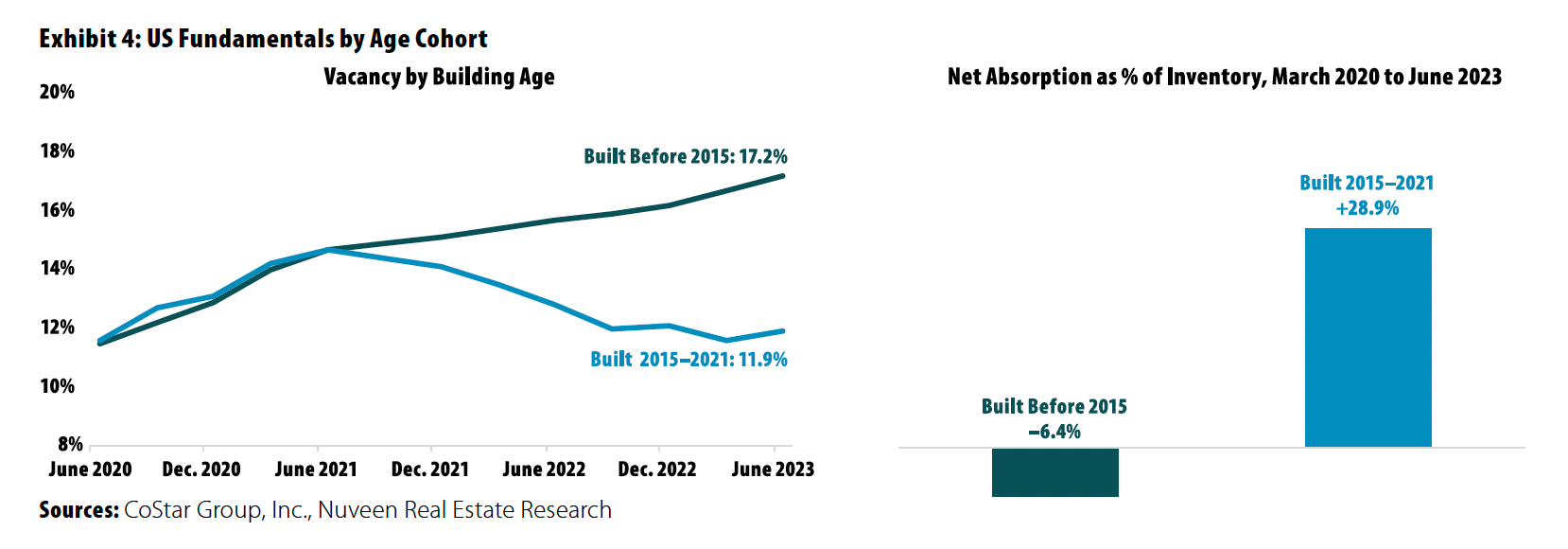

After factoring in the expected supply and demand dynamics, this deficit should be cut to 6.3%, or about 405 million square feet, over the next decade. To put these numbers into perspective, inventory of 4 and 5 Star office is 3.1 billion square feet, 3 Star inventory is 2.9 billion square feet, and 1 and 2 Star inventory is 1.4 billion square feet.6 In a study published earlier this year, CBRE observed that just 10% of US office buildings accounted for 80% of the vacancy created since 2020.7

Although time will heal market fundamentals, current owners face plenty of near-term risks that may prove insurmountable, including debt maturities, escalating capital expenses, and a currently weak leasing environment. One silver lining is that this distress will help force a necessary repricing of assets to current market conditions and will allow new owners with lower cost bases a greater ability to improve assets enough to compete for future demand.

Even with an expanding knowledge-based workforce, the US will likely need less office space in 2033 than it needed prior to the pandemic. Although this market correction is only halfway through, some clear trends have emerged. Lost occupancy has been skewed heavily toward older properties, especially those that have not undergone significant renovations. These properties generally lack rents high enough to justify the investment and are increasingly becoming stranded assets. On the other hand, newer properties that are built to modern standards, including sustainable designs, hotel-quality lobbies, high ceilings, ample natural light, amenity floors, indoor/outdoor spaces, and the latest standards in air quality and data infrastructure, are increasingly taking market share. This flight to quality was already playing out over the past cycle but has accelerated since the pandemic and will likely be particularly significant in the years to come (Exhibit 4).

Obsolescence Will Vary by Market

How can a market counteract an overall reduction in office space per employee? Add more employees! It’s been no secret that the Sunbelt markets continue to grow in population, and the tailwinds for these markets are unlikely to abate anytime soon. Using the same methodology previously outlined that accounts for decreasing space per worker but also job growth, we find that Tampa, Dallas, Austin, and Raleigh will actually have a deficit of office space by 2033. Markets such as Phoenix, Atlanta, and Denver will be near equilibrium. Meanwhile, the gateway markets are likely to face an overall surplus of office unless space can be removed from the market by demolition or conversion into other uses.

Are Prime Asia-Pacific Offices Obsolete?

The future of Asia-Pacific offices is not dead and by no means obsolete. Office occupancy has recovered smartly across many regional markets since pandemic-led mobility restrictions eased, with many structural reasons underpinning this performance. As mentioned previously, there is a strong cultural bias for physical office attendance because of the importance placed on face-to-face interaction and team building. This trend is especially true in Japan and South Korea. Second, tight living spaces especially across many gateway cities continue to draw workers back to offices. Household space per person is estimated at only 170 square feet in Hong Kong and 320 square feet in Singapore; by contrast, Australian and American workers have more than 800 square feet of space at home, allowing for a more conducive remote working environment. Last, efficient and well-connected public transport networks across many densely populated regional cities allow workers to spend less time and money commuting. These trends are supported by office attendance rates, at close to 80% for Japan, Hong Kong, and South Korea and only around 50% for the UK and US, according to CBRE.

However, near-terms risks and longer-term considerations must also be considered. Regional economic growth has been weakening since the start of the year, and although a recession is unlikely, the hit to business sentiment and profitability has started to dampen medium-term occupier demand for office space. The downside impact will be especially magnified in fundamentally uneven markets with strong future supply. Over the coming three years, around 31% and 19% of new office space (as a percentage of existing stock) is estimated to enter the market in Shanghai and Beijing, respectively—two markets with vacancy nearing 20%. In the first quarter of 2023, a fundamentally driven cyclical downturn dampened rents in Hong Kong, Tokyo, Beijing, and Melbourne. And with increasing layoffs in the financial services and tech industries, the near-term outlook also looks decidedly less certain. Positive but more muted rent growth was also registered in Singapore and Seoul following the surge in rents last year; however, these two markets are better buffered because more constrained supply will help mitigate any potential pullback in occupier needs. All said, though the structural underpinnings for Asia-Pacific offices will likely stay resilient, poor-quality assets located in less-prime locations still risk obsolescence. Historically, these buildings were more at risk of vacancy during a cyclical downturn. More than ever, investors should focus on well-located, quality buildings with strong ESG credentials; in doing so, they will reap the rewards of strong and resilient recurring income returns.

Environmental Agenda Accelerating Office Obsolescence Risk in Europe

Energy efficiency and decarbonization have become particularly pertinent for European investors and corporate occupiers post-pandemic, accelerating the bifurcation between relevant and obsolete office stock. Corporate commitments to decarbonize are on the rise, and net zero carbon pathways are becoming synonymous with the highest levels of certification, but the current supply of stock to meet demand is wholly inadequate. Corporate occupiers not only view their commitments to lower emissions as a reputational issue but perceive other benefits will result from well-being and productivity, reduced staff turnover, and cheaper operational costs. Post-pandemic office attendance and soaring energy bills as a result of the war in Ukraine have served to reinforce a trend that was already prevalent.

European cities vary considerably in terms of the age of office stock, with 66% of offices in Milan and well over half the stock in Stockholm, Munich, and Berlin built before 1980. London, Amsterdam, and Brussels fare better, but even in these markets, most of the stock is pre-2000. Upgrading space at lease expiry is expected to play a major role in reversing obsolescence in coming years. According to JLL, more than 100 million square feet of space in London, Paris, and the German Big 58 have leases that are due to expire in 2024–2025. Given that real estate investors are also increasingly aligned with the view that sound ESG credentials will drive fiduciary outperformance, either by adding value or by defending them from value erosion, environmental upgrades will play an important role in any repositioning strategy.

The Risks Are Real, but There Will Be Winners

Overall, the office market is undoubtedly challenged right now and will be for some years to come. However, our analysis suggests that some mitigants will face expected headwinds, including future job growth and a renewed commitment to building space that fosters collaboration. To be very clear, this is not a “back-up-the-truck” moment for office. It will be a good stock picker’s market for the next few years, though. Careful asset selection backed by strong market research and purposeful business plans will generate some excellent investments within the space. Regardless of region, investors will be wise to prioritize green credentials and spaces that foster collaboration.

1. Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers, US Bureau of Labor Statistics, retrieved from FRED, Federal Reserve Bank of St. Louis.

2. “Getting America Back to Work,” Kastle.

3. Estimate includes three weeks of vacation, ten paid holidays, seven days traveling for business, and seven miscellaneous days, which could include sick time, planned work-from-home days, etc.

4. This assumes 10% full-time remote, 60% hybrid schedules averaging three days in the office, and 30% fully back in the office. This also assumes that ten days previously away from the office per year are “made up” by hybrid employees who are expected to average three days in the office per week.

5. Ethan Bernstein and Ben Waber, “The Truth About Open Offices,” Harvard Business Review, Nov.-Dec. 2019.

6. CoStar Group, Inc., for Nuveen Real Estate’s 35 Resilient U.S. Cities.

7. “Office Buildings Hardest Hit by Pandemic Share Common Characteristics,” CBRE, April 4, 2023.

8. Hamburg, Berlin, Ruhr-Düsseldorf-Cologne region, Frankfurt, and Munich.

Paul Leonard is Director of Research, Real Estate, Americas; Andy Schofield is Director of Research, Real Estate, Europe; Harry Tan is Head of Research, Real Estate, Asia-Pacific; Donald Hall is Global Head of Research; and Chad Phillips is Global Head of Workplace, Retail and Mixed-Use, at Nuveen Real Estate.

This article has been prepared solely for informational purposes and is not to be construed as investment advice or an offer or a solicitation for the purchase or sale of any financial instrument, property, or investment. It is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. The information contained herein reflects the views of the author(s) at the time the article was prepared and will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing or changes occurring after the date the article was prepared.

About PREA

About PREA